Unknown Facts About Tax Consultant Vancouver

Wiki Article

The Vancouver Tax Accounting Company Statements

Table of ContentsNot known Details About Small Business Accountant Vancouver The Definitive Guide to Outsourced Cfo ServicesFacts About Vancouver Tax Accounting Company RevealedSee This Report on Tax Consultant Vancouver

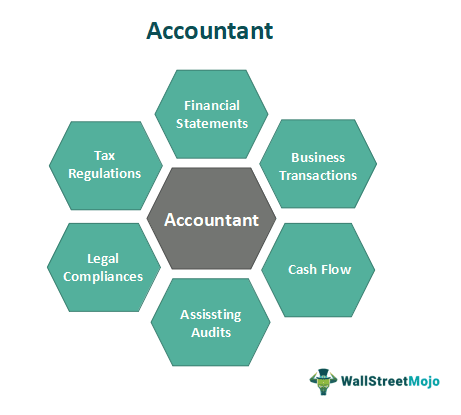

This location is a really crucial area where organizations regularly require advice from outdoors specialists. Certified public accountants can offer guidance as well as offer implementation aid in reviewing and choosing new accounting and also functional software program solutions. They can help companies create project groups to work on executing new bookkeeping requirements like leases, profits acknowledgment, and credit scores losses that require significant adjustments in exactly how finance divisions represent these purchases.Certified public accountant companies can examine a business's monetary statements, which might be needed by loan providers, government gives, or shareholders. Audited monetary declarations offer assurance that the monetary declarations are rather stated and conform with GAAP. Vancouver tax accounting company. CPAs might also supply audits of a business's internal control over monetary reporting. An additional service CPAs can provide pertaining to financial declarations is compilation or review.

In a compilation, the certified public accountant does not give guarantee on the accuracy of the financial statements however reviews them and takes into consideration whether they show up suitable in kind as well as are totally free from noticeable material misstatements. In a testimonial, the CPA executes analytics, makes questions, and carries out various other procedures to acquire limited assurance on the financial statements.

Company owner ought to consider their present as well as near-term demands from a CPA. A lot of CPAs would certainly be happy to discuss your needs as well as exactly how their firms can (or can not) offer those services, together with the charges they will bill, so you can locate a certified public accountant that you are comfy working with. small business accounting service in Vancouver.

Not known Facts About Tax Accountant In Vancouver, Bc

is a quantity owed to a supplier or credit report for completed products or services. A tiny business may have temporary settlements to banks. The main internet site of the IRS has more information on recordkeeping. Tax obligation preparation as well as declaring isn't fun yet it's crucial to make certain whatever is taken care of properly.

Will you require to prepare regular or regular monthly economic records or only quarterly and also yearly reports? Is there a person in your office that is qualified to deal with crucial bookkeeping and bookkeeping services?

Some Known Details About Small Business Accountant Vancouver

Accounting professionals are quite adaptable and also can be paid hourly. Additionally, if you do choose to outsource accounting and also bookkeeping services, you wouldn't be in charge of supplying advantages like you would certainly for an internal staff member. If you decide to hire an accounting professional or accountant, here are a couple of pointers on finding the ideal one: Check referrals as well as previous experience Make sure the prospect is informed in bookkeeping software application as well as technology Ensure the prospect is proficient in accounting plans as well as treatments Evaluate that the candidate can plainly communicate economic language in words you comprehend Make certain the candidate is sociable and also not a robotic Local business proprietors and business owners generally outsource bookkeeping and accounting services.We compare the ideal right here: Wave vs. Zoho vs. Quick, Books Don't neglect to download our Financial Terms Rip Off Sheet, which includes essential audit as well as bookkeeping terms.

The audit occupation remains to really feel the results of the modern technology interruption that has actually impacted all markets. One effect is that even more firms will choose to outsource their accountancy functions in 2020 as well as 2021, according to Financial resource Online. That's good news for accountants who intend on beginning an audit company.

Similar to any kind of local business, establishing a bookkeeping technique requires an excellent offer of job, however as Thomson Reuters notes, audit companies are presently among one of the most profitable of all little companies. The best means to ensure the success of a new accountancy business is to have a well-founded plan that prepares the click this link procedure to survive its vital initial year.

8 Simple Techniques For Pivot Advantage Accounting And Advisory Inc. In Vancouver

Accounting professionals and also various other specialists are increasingly choosing to function independently as opposed to as employees. Finances Online reports that large audit firms are struggling to fill their open positions as the unemployment rate for accountants hovers around 2%. However, not all accounting professionals are cut out to invest their occupation benefiting another person.Starting any kind of organization requires drive and also initiative. Success additionally relies on the support of your family members. Getting revenue needs marketing how does the accountant movie end ability to drum up clients. The way to gain the highest possible charges is by differentiating the company by means of a bookkeeping specialty, which needs its very own collection of abilities as well as experience.

Few self-employed accounting professionals become their very own bosses right out of college. In virtually every situation, they first acquire beneficial job experience as an employee of an accounting firm.

Report this wiki page